Strategic Healthcare Mergers and Acquisitions (M&A)

Diagnostic Imaging Trends -- 2013

11/27/2013

As part of our Healthcare M&A and strategic consulting services, we offer the following overview of the Diagnostic Imaging market as a context to understand mergers and acquisitions in the sector.

- Growth in Diagnostic Imaging Procedures Slowing Down

Recent data shows that the number of physician visits by patients 65 or older resulting in an imaging exam is consistently trending downward, from 12.8%in 2003 to 10.6% in 2011. Similarly, Medicare spending per enrollee for imaging has declined from $418 in 2006 to $390 in 2011.Maturation of technological advances, over-saturation of imaging centers, radiation awareness, new guidelines from the American College of Radiology reducing duplicative studies and new healthcare reimbursement policies have all led to the slowdown. - New Policies Lowering Reimbursements

The Deficit Reduction Act of 2007 and changes in practice expense data, equipment utilization estimations, and other calculations by CMS have reduced imaging payments. The Affordable Care Act aka ObamaCare will lower reimbursements further, focusing on bundling procedures and diagnostic tests. Some of the newest bundled codes pertain to abscess drainage, breast biopsy, and intravascular stents.

- Doing More with Less

Following past trends of routine imaging without stringent correlations with medical necessity, imaging departments must do more with less through more conservative practices and advanced visualization tools.

- Decreased Incomes for Radiologists

Reimbursement cuts have led to decreased compensation rates for practitioners as facilities are on tighter budgets.Radiologists now more than ever compete on price as hospitals face budget restraints and mobile technologies allow radiologists to operate offsite. Confusion around reimbursement and the radiologist’s role have prompted many practices to reduce hirings and manage salaries.

- Rise of Teleradiology

Fueled by the need to meet new healthcare reform requirements and improve workflow efficiencies, there is greater reliance on remote-viewing systems that enable the digital transmission of radiographic images. Remote-viewing systems are driving hospital’s outsourcing of radiology services to cut costs.

- Mobile Device Radiology to Increase

Mobile applications compress radiology images taken in the hospital or a physician’s office to a secure network and allow the transfer to portable wireless devices such as an iPhones and iPads.

- New Technologies Offer Better Visualization

Visualization advancements include the use of Direct digital radiography (DR) units that feature flat panel image receptors using LEDtechnology that create imagesoptimal for digital transfer and viewing on mobile devices and laptops.Flat panel monitors also create longer lasting displays with better self-calibration.

- Workflow Sharing a Priority

Following consolidation and healthcare reforms, shared workflow platforms will enable multiple sites with disparate PACS to integrate and synchronize data among hospitals and other providers at local, regional and national levels.Cloud applications will become more prevalent.

- Next Generation MRIs

New MRI technologies include noiseless MRIs, intra-operative MRIs used during neurosurgery and interventional imaging systems to replace angiography for complex interventional procedures.Other advancements include flexible MRI coils to better mold to the anatomy of patients over the current standard of hard coils.

- Ultrasound Advances

Developments in ultrasound use for interventional and therapeutic applications include wireless transducers that can be used to image up to 10 feet from a console to enhance clinicians’ access to the patient and eliminate the impediment of cables during imaging.Compared to other modalities, Intraoperative Ultrasound has been shown to reveal more lesions, by better defining the relationship between biliary structures, and by improving discrimination between benign and malignant lesions.

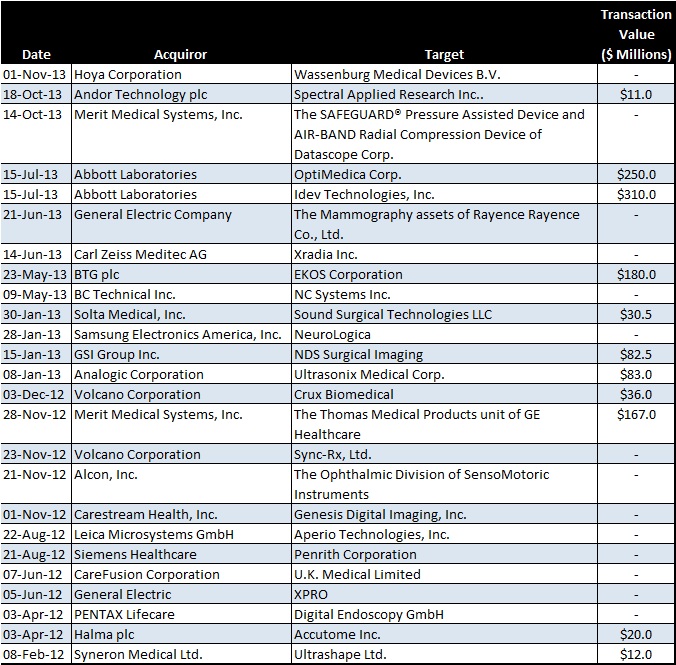

Recent healthcare M&A activity within diagnostic imaging includes: