Strategic Healthcare Mergers and Acquisitions (M&A)

Urology Trends 2014

08/12/2014

Key dynamics in the urology sector, helping to fuel healthcare M&A activity, include:

- Urological Devices Market Expansion

Fueled by increases in sales of urinary catheters and urological endoscopes, the U.S. urological devices market is estimated to reach over $5.4b by 2016. Urinary continence products account for almost 40% of the market – the largest among all product categories. Among other factors, favorable reimbursement, improved diagnosis technology and rates for prostate cancer and benign prostatic hyperplasia (BPH) and the aging population have contributed market growth (Source: iData). Approximately 50% of men exhibit evidence of BPH by age 50 with nearly half of these cases requiring treatment. By age 80, 75% of men show signs of BPH. - Prostate Cancer Treatment Device Market is Set to Grow at Fastest Rate

Growing market acceptance of robotic prostatectomy and External Beam Radiotherapy is expected to grow the prostate cancer treatment device market at double-digit rates until 2018. Prostate cancer treatment modalities include Intuitive Surgical’s daVinci system for robotic prostatectomy, external beam radiation therapy led by Varian Medical and Siemens, and brachytherapy dominated by C.R. Bard. - New Technologies on Horizon

New treatment advances include (a) new point-of-care diagnosis and treatment of urinary tract infections using clinical urine samples, (b) new cryosurgical treatments allowing the surgeon to precisely map cancerous cells, freezing and killing the cells that radical prostatectomy are unable to reach, (c) new robotic applications and (d) an artificial kidney. Artificial kidney developments include the combination of nano-scale engineering and cellular biology to create an implantable device, eliminating patient need for external dialysis or immune suppressant medication. - Reimbursement and Setting Determine Mode of Treatment

Reimbursements and physician fees for procedures vary both by treatment and by treatment setting. Reimbursement rates are highly dependent on facility reimbursement, which incentivizes physicians to opt for more cost-effective treatments. Monopolar Transurethral resection of the prostate (TURP) procedures have traditionally been the standard of care in treating BPH. In hospital settings, physicians receive the highest fees for performing outpatient TURP procedures followed by laser enucleation. As urologists move away from small private practices to hospitals, physicians will have the most financial incentives to perform TURP and laser enucleation procedure.

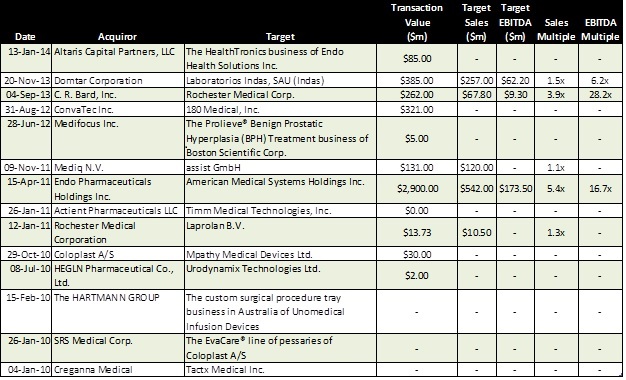

Data on selected M&A transactions in the urology area is set forth below: